Financial leverage ratio analysis is a crucial tool for businesses to assess their financial health and make informed decisions. It involves analyzing a company’s financial statements, specifically its debt and equity components, to determine its level of leverage or financial risk. As the business landscape becomes more competitive and volatile, it is essential for companies […]

Tag Archives: financial

Financial statements are an essential tool for businesses to communicate their financial performance to stakeholders. They provide a snapshot of a company’s financial health and are used by investors, creditors, and other interested parties to make informed decisions. However, these statements are only useful if they accurately represent the financial position of the company. Therefore, […]

Asset allocation optimization methods are essential tools for investors looking to maximize their returns while minimizing risk. These methods involve strategically diversifying investments across different asset classes, such as stocks, bonds, and cash, based on an investor’s risk tolerance, goals, and time horizon. By using these methods, investors can create a well-balanced portfolio that is […]

Real estate investment has long been a popular choice for investors looking to build wealth and secure their financial future. However, not all properties are created equal, and it’s essential for investors to have a solid understanding of the evaluation criteria used to assess the potential of a property before making any investment decisions. In […]

Asset allocation is a crucial component of any successful investment strategy. It involves dividing your portfolio among different asset classes, such as stocks, bonds, and cash, with the goal of achieving the optimal balance between risk and return. However, simply diversifying your investments is not enough to ensure maximum returns. This is where asset allocation […]

When it comes to investing in real estate, there are many factors that come into play. From location and property type to market trends and financial projections, the process of evaluating a potential investment can seem overwhelming. That’s why having a set of criteria to guide your decision-making can be crucial to making informed and […]

As the cost of higher education continues to rise, it has become essential for families to start planning early for their children’s college tuition. With the average cost of four years at a private university now exceeding $200,000, it’s no wonder that parents are feeling overwhelmed and anxious about how they will afford their child’s […]

Budgeting is a crucial aspect of personal finance that helps individuals plan and manage their money effectively. While short-term financial goals, such as saving for a vacation or paying off credit card debt, are important, it is equally essential to focus on long-term financial goals. These goals can range from building an emergency fund to […]

Portfolio rebalancing strategies are essential for any investor looking to maximize their returns and manage risk in an ever-changing market. As the name suggests, portfolio rebalancing involves adjusting a portfolio’s composition to align with the investor’s long-term financial goals. This process involves selling off investments that have grown too much and reinvesting in underperforming assets. […]

Investing in hedge funds can be a daunting task, as these alternative investments come with their own unique set of risks and rewards. As an investor, it is important to thoroughly evaluate the criteria that make a hedge fund a sound investment opportunity. In this article, we will discuss the various factors that should be […]

Insurance is a crucial aspect of financial planning. It provides protection against unexpected events and helps individuals and businesses manage risks. However, with numerous insurance companies and policies available, finding the right coverage can be overwhelming. This is where insurance policy comparison techniques come in handy. With the right techniques, you can effectively compare different […]

Consumer credit utilization is a crucial aspect of personal finance management. It refers to the amount of credit you are currently using compared to your total available credit. This metric is often used by lenders and credit scoring models to determine an individual’s creditworthiness. In this article, we will dive into the world of consumer […]

Are you struggling to pay off your credit card debt? You’re not alone. According to a recent study, the average American household carries over $16,000 in credit card debt. And with high interest rates and minimum payments that barely make a dent, it’s easy to see how this debt can quickly become overwhelming. But don’t […]

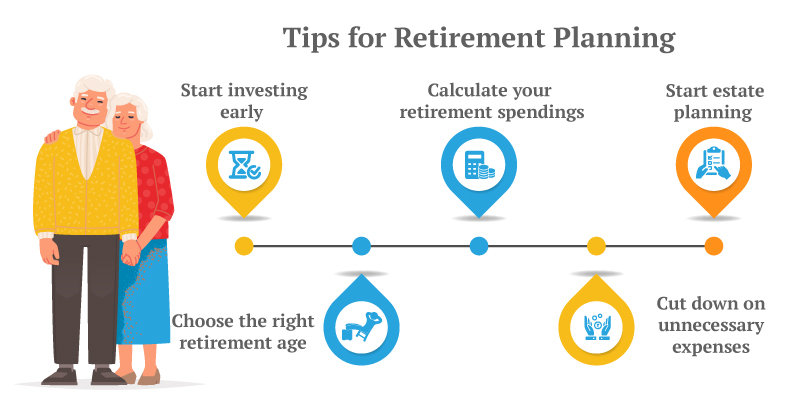

Retirement is a time that many people look forward to, a period of relaxation and enjoyment after years of hard work. However, without proper planning and financial preparation, retirement can quickly turn into a source of stress and worry. This is where retirement savings planning strategies come into play. These strategies are essential for ensuring […]

As with any investment, there is always a level of risk involved. However, when it comes to interest rates, this risk can have a significant impact on your financial portfolio. This is where interest rate risk assessment methods come into play. These methods help investors and financial institutions evaluate the potential risks associated with changes […]

Cryptocurrency has taken the world by storm, with its promise of decentralized and secure transactions. Many people are interested in investing in crypto but are intimidated by its complex nature. With new projects and coins emerging constantly, it can be overwhelming for beginners to know where to start. This beginner’s guide will provide you with […]

Investing in the stock market can be a thrilling and potentially lucrative endeavor, but it also comes with inherent risks. To navigate the complexities of the investment landscape effectively, market research plays a crucial role in the decision-making process. This comprehensive guide explores the key aspects of market research for investment decisions, empowering you to […]

Financial inclusion is a critical aspect of socioeconomic development, empowering individuals and communities to access and utilize financial services. The development of effective financial inclusion policies is crucial to create a supportive environment for individuals and businesses to participate fully in the financial system. Financial Inclusion Policy Development The process of developing financial inclusion policies […]