The financial services industry has undergone a major transformation in recent years with the rise of financial technology, or fintech. Fintech companies have revolutionized the way we manage our money, from mobile banking to digital payments to robo-advisors. These innovations have provided consumers with more convenient, affordable, and transparent financial services. For financial institutions, adopting fintech is essential for staying competitive and meeting the changing needs of their customers. In this article, we will explore the benefits of fintech adoption and discuss strategies that financial institutions can use to successfully implement fintech into their operations.

Benefits of Fintech Adoption

There are numerous benefits to adopting fintech, including increased efficiency and cost savings, improved customer service, and more personalized offerings. Let’s take a closer look at each of these benefits:

Increased Efficiency and Cost Savings

One of the biggest advantages of fintech adoption is the potential for increased efficiency and cost savings. By leveraging technology, financial institutions can automate many of their processes, which can lead to significant cost savings. For example, mobile banking allows customers to deposit checks, transfer funds, and pay bills without having to visit a physical branch. This not only saves time for customers but also reduces the need for the bank to have multiple brick-and-mortar locations.

Furthermore, fintech solutions can help financial institutions streamline their back-office operations, such as loan processing and risk assessment. With the use of artificial intelligence and machine learning, tasks that were once done manually can now be automated, resulting in quicker turnaround times and reduced operational costs.

Improved Customer Service

In today’s fast-paced world, customers expect convenience and accessibility when it comes to managing their finances. Fintech provides just that – by offering digital solutions, financial institutions can provide their customers with 24/7 access to their accounts from anywhere in the world. This not only improves the customer experience but also saves time and resources for both the bank and the customer.

Moreover, fintech can help financial institutions deliver more personalized services to their customers. With the use of data analytics and AI, banks can gain valuable insights into their customers’ spending habits and financial goals, allowing them to offer tailored solutions and recommendations. This not only improves customer satisfaction but also helps financial institutions retain their customers.

More Personalized Offerings

Fintech has also opened up new opportunities for financial institutions to offer personalized products and services. For example, robo-advisors are gaining popularity as a cost-effective alternative to traditional financial advisors. These digital platforms use algorithms to create personalized investment portfolios based on an individual’s risk tolerance and financial goals. This allows financial institutions to cater to a wider range of customers with varying needs and preferences.

Furthermore, the use of open banking APIs (application programming interfaces) has enabled financial institutions to partner with third-party fintech companies to offer more comprehensive and personalized solutions. By sharing customer data securely, banks and fintech companies can work together to provide customers with a seamless and customized experience.

Fintech Adoption Strategies

While the benefits of fintech adoption are clear, it is important for financial institutions to carefully consider their strategies before implementing any new technology. Here are six key strategies that financial institutions can use to drive successful fintech adoption:

1. Define Your Objectives

Before adopting any fintech solution, it is crucial to clearly define your objectives. What do you hope to achieve by implementing this technology? Is it increased efficiency, improved customer service, or cost savings? Having a clear understanding of your goals will help guide your decision-making process and ensure that the chosen solution aligns with your objectives.

2. Understand Your Customer Needs

To successfully implement fintech, it is essential to understand the needs and preferences of your customers. Conducting market research and gathering customer feedback can provide valuable insights into what solutions your customers are looking for. This will help you choose the right fintech solution and ensure that it meets the needs of your target audience.

3. Build a Strong Partnership

Collaboration is key to successful fintech adoption. Financial institutions should look to build strong partnerships with fintech companies to leverage their expertise and technology. This also allows for seamless integration between different systems, providing a more efficient and effective solution for both parties.

4. Invest in Training and Education

Adopting new technology requires not only financial investment but also investment in training and education. It is important for financial institutions to provide proper training to their employees to ensure they are equipped to use the new technology effectively. This will not only improve the adoption process but also enhance employee productivity and satisfaction.

5. Prioritize Data Security

With the increasing use of digital solutions, data security has become a top concern for consumers. Financial institutions must prioritize data security when adopting fintech solutions to build trust with their customers. This includes implementing robust security measures and complying with regulations such as GDPR (General Data Protection Regulation) and PSD2 (Revised Payment Service Directive).

6. Monitor and Measure Performance

Once a fintech solution has been implemented, it is important to monitor and measure its performance. This involves tracking key metrics such as customer satisfaction, cost savings, and efficiency gains. This data can then be used to make any necessary adjustments and improvements to the adopted solution.

Challenges of Fintech Adoption

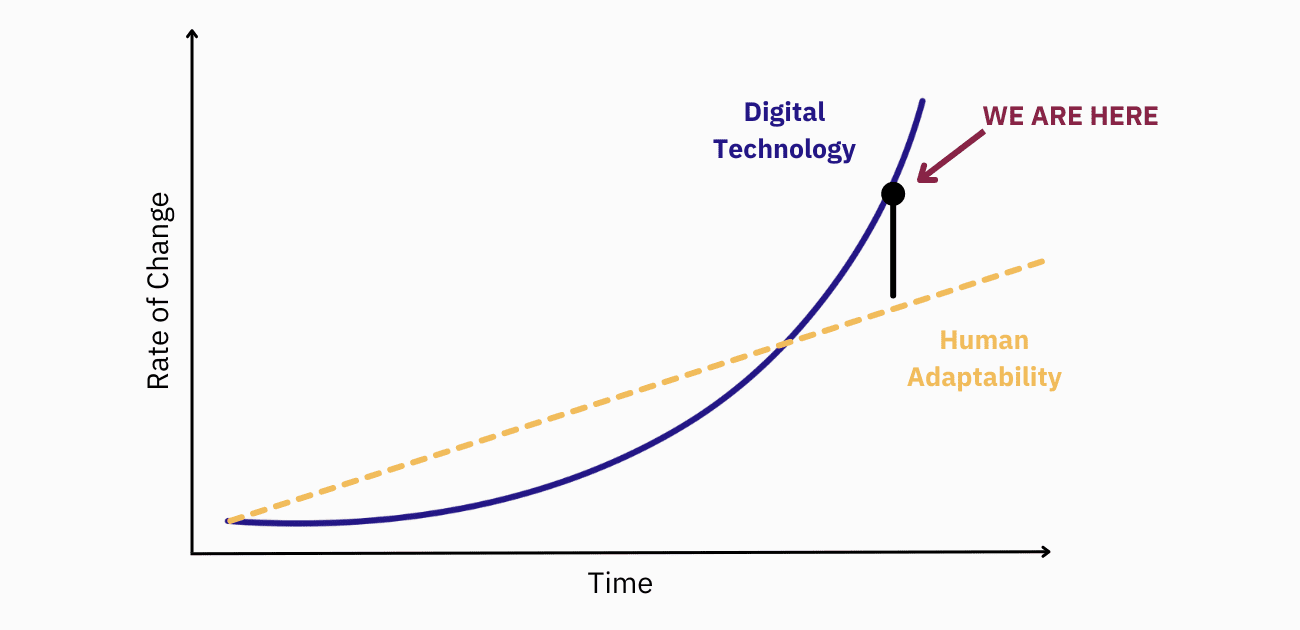

While there are many benefits to adopting fintech, financial institutions also face several challenges when integrating new technology into their operations. These challenges include regulatory hurdles, legacy systems, and cultural resistance.

Regulatory Hurdles

The financial services industry is highly regulated, and this can pose challenges for fintech adoption. Fintech companies are often subject to the same regulations as traditional financial institutions, making it difficult for them to innovate and disrupt the market. Therefore, it is important for financial institutions to carefully assess the regulatory landscape before adopting any new technology.

Legacy Systems

Many financial institutions still rely on legacy systems that are not easily compatible with new fintech solutions. This creates roadblocks when trying to integrate new technology, resulting in longer implementation times and higher costs. To overcome this challenge, financial institutions should consider investing in modernizing their IT infrastructure to ensure they are able to adopt new technology seamlessly.

Cultural Resistance

Introducing new technology can also face resistance from employees who may be hesitant to change their processes and ways of working. This cultural resistance can slow down the adoption process and hinder the potential benefits of fintech. To overcome this, financial institutions should involve employees in the decision-making process and provide proper training and support to help them adapt to the changes.

Conclusion

Fintech adoption is no longer a choice but a necessity for financial institutions looking to stay competitive in today’s market. By embracing digital solutions, financial institutions can reap numerous benefits such as increased efficiency, improved customer service, and more personalized offerings. However, adopting fintech can also be a complex and challenging process, requiring careful consideration of objectives, customer needs, partnerships, training, data security, and performance measurement. Despite the challenges, the potential benefits of fintech adoption far outweigh the risks, and financial institutions must embrace this technology to drive innovation and growth.

wfriv.xyz