As the housing market continues to experience fluctuations and uncertainty, mortgage default rates have become a topic of concern for both homeowners and lenders. These rates refer to the percentage of mortgages that are in default, meaning the borrower has failed to make payments on their loan. In this article, we will explore the impact […]

Category Archives: Mortgage

When it comes to purchasing a home, one of the key factors that lenders consider is your debt to income ratio. This ratio is used to determine your ability to afford a mortgage and ultimately, the amount of money you can borrow. As a potential home buyer, understanding the mortgage debt to income ratio is […]

If you are looking for a fulfilling career in the finance industry, mortgage originator jobs might be just what you are looking for. As a mortgage originator, you will play a crucial role in helping people achieve their dreams of homeownership. This job requires a unique combination of financial expertise, communication skills, and salesmanship. In […]

Mortgage origination date is an important term that every borrower should understand before taking out a mortgage. It refers to the date on which a loan is issued and begins accruing interest. This date is crucial as it affects the amount of interest you will pay over the life of your loan. In this article, […]

Mortgage origin, a term used frequently in the world of finance and real estate, holds significant importance in the process of home buying. While many are familiar with this term, few understand its true meaning and origins. In this article, we will dive into the history and significance of mortgage origin, shedding light on its […]

Mortgage insurance is an important aspect of the home buying process, and understanding how it works is crucial for any potential homeowner. With the rise in housing prices, most buyers will need a mortgage loan to purchase a property. And with that comes the added cost of mortgage insurance. But what exactly is mortgage insurance? […]

Mortgage holidays have become a popular option for homeowners in recent years, providing them with some much-needed financial relief. With the ongoing pandemic and economic uncertainty, many borrowers are turning to mortgage holidays as a means to manage their finances and avoid defaulting on their payments. If you’re a Halifax customer, you may be wondering […]

As a homeowner or aspiring homeowner, the concept of a mortgage house is likely not unfamiliar to you. However, fully understanding what a mortgage house is and how it works is crucial in making informed decisions about your finances and homeownership journey. In this article, we will delve into the intricate details of mortgage house […]

Are you a homeowner looking for information on how to manage your mortgage? Are you wondering what it means to be a mortgage holder and what responsibilities come with it? Look no further, as this comprehensive guide will provide all the information you need to know about being a mortgage holder. As a mortgage holder, […]

Are you considering taking out a mortgage with HSBC? As one of the largest banking and financial services institutions in the world, HSBC offers a wide range of mortgage options for home buyers. But with so many different terms and conditions, it can be confusing to navigate the world of mortgages and understand what HSBC […]

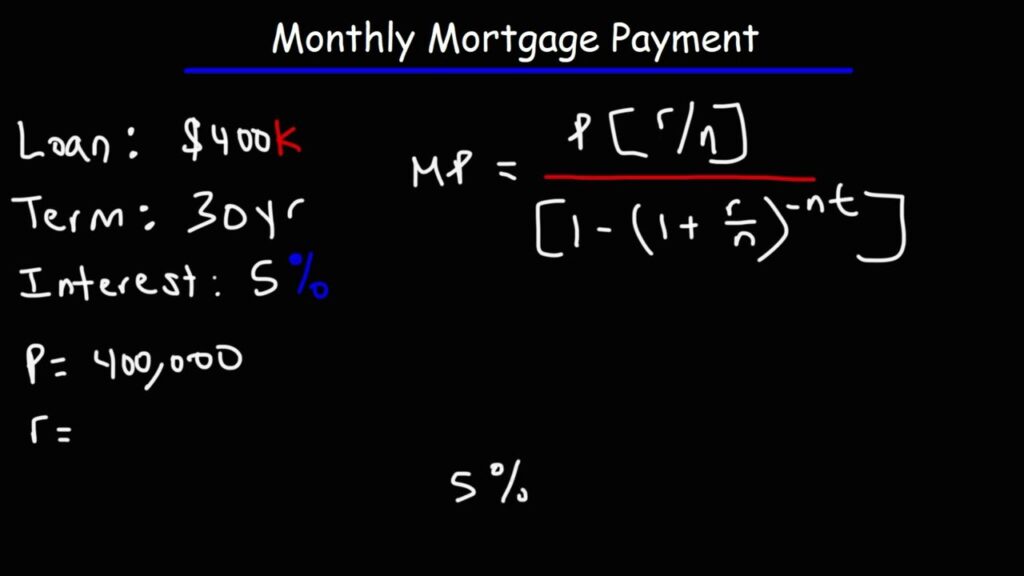

Are you looking to buy a new home, but unsure of how much mortgage you can afford? Don’t worry, you’re not alone. Many people find themselves in this predicament, and it’s important to understand your financial capacity before taking on a large mortgage. In this article, we will delve into the topic of mortgage how […]

Mortgage Hub Bank of Ireland is one of the leading mortgage providers in the country. With its wide range of mortgage options and competitive interest rates, it has become a go-to choice for home buyers and property investors. In this comprehensive guide, we will take a closer look at everything you need to know about […]

Are you tired of the endless paperwork and long waiting times associated with traditional mortgage applications? Look no further than Mortgage House, Australia’s leading non-bank lending institution. With their online platform, you can easily manage your mortgage account and payments with just a few clicks. In this article, we’ll explore everything you need to know […]

Mortgage-backed securities (MBSs) are investment products that have been around for decades, but they gained notoriety after the 2008 financial crisis. Today, MBSs remain a popular choice among investors looking for stable income streams. However, many people still wonder, “Can I buy a mortgage-backed security?” The answer is yes, and in this comprehensive guide, we’ll […]

The world of mortgages can be a confusing and ever-changing one, with interest rates constantly fluctuating and affecting the cost of buying or refinancing a home. As a potential homeowner, it’s important to stay informed about mortgage rates and how they impact your financial decisions. So, did mortgage rates go down this week? The answer […]

The term mortgage resonates far beyond its narrow financial definition, carrying profound implications that seep into our language and everyday discourse. This article delves into the metaphorical depths of this ubiquitous term, exploring its figurative uses and the insights it provides into our understanding of personal, social, and societal dynamics. Understanding the Concept of Mortgaging […]

Purchasing a home and paying off the mortgage is often seen as a major achievement for many individuals. However, there may come a time when you need access to additional funds and consider mortgaging your paid-off house. This decision should not be taken lightly, as it can have significant financial consequences. In this article, we […]

Are you looking for a career that is financially rewarding and intellectually stimulating? Are you interested in the world of finance and real estate? If so, then a career in mortgage underwriting may be just what you are looking for. In this comprehensive guide, we will take an in-depth look at mortgage underwriting, including its […]

- 1

- 2